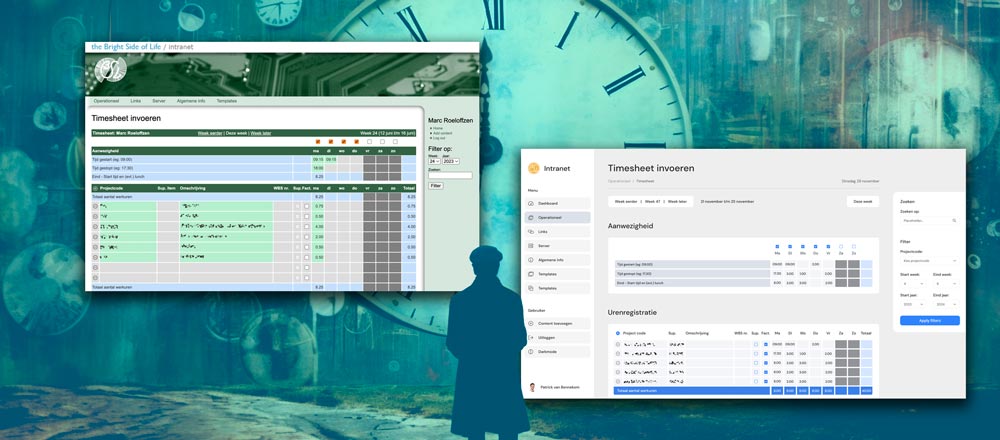

Evolution by design is part of our strategy. We know that the needs of clients will evolve over time. It’s no surprise that our engineers and designers are working on a new release of ABN AMRO’s Signature Registration System (SRS). This is a custom-made global solution developed by BSL to manage and verify signatures and ABN Powers of Attorney (PoA) for their personnel. The goal: improving the efficiency and security of bank processes.

In this digital age, it’s surprising to realize how much business still depends on the right signature appearing on agreements. And in international businesses, with individuals throughout the world authorized to sign agreements, how do you know you have the right signature? And what is the authorization limit of the person who signed?

ABN AMRO – a multi-national concern

The ABN AMRO is a major international bank. The ABN approached BSL with just this problem, and we came up with a custom solution: The Signature Registration System (SRS). A reliable and secure system for storing, managing and distributing signatures worldwide. Integrated with their Human Resources system, SRS does far more than manage signatures. By linking signatures to the bank’s personnel system and to local Chambers of Commerce, it provides all the tools needed to verify signatures, and the authority (Powers of Attorney) assigned to each employee.

SRS has been in use for many years, with new web applications designed and delivered in 2013. A dedicated front-end is used worldwide by ABN AMRO personnel for signature verification – a vital step in the authorization of bank transactions. Authorized personnel manage this verification process using a custom web app to create and maintain PoAs and employee details, updated using regular imports from Human Resources/Personnel.

Evolution by design – a new release

As part of the evolution of SRS in response to changing requirements, we’ve been working on a new release. At the request of ABN AMRO and with the aim of improving efficiency within the bank, BSL recently developed a new version of SRS. Several improvements were introduced that reduce the time needed to perform daily administration tasks. These included the introduction of a new workflow, and many changes to the user interfaces.

Further changes planned

With the focus on enhancing the efficiency of bank processes, our engineers have continued to work alongside ABN personnel in the PoA office. We’ve worked out a further set of improvements, using feedback from a series of training sessions. As a result a new release has been planned, incorporating additional modifications to user interfaces and changes to the workflow. Extra functions will also be added so that users are able to generate and export a range of useful management reports. Work on these new SRS features is already well underway, with a release scheduled before the end of 2015. However, the flexibility of our software ensures that our developers never stand still. In close cooperation with ABN AMRO we are already working on specifications aimed at improving the workflow functionality supported by SRS, based on extensive changes to the employee data imports. This will achieve further efficiency improvements in 2016.

The future

Our software is designed to evolve as the needs of our customers change. We are confident that ABN AMRO SRS will continue to evolve over coming years to meet the needs of such a complex organization, and to adapt to any legislation changes in the future.